GM Financial Ranks Average In J.D. Power 2025 U.S. Auto Loan Satisfaction Study

İLGİ ÇEKENLER

Highest level of safety: MINI Cooper Electric wins Euro NCAP Best in Class

The fully electric MINI Cooper - which has already been awarded 5 stars in the...

Bentley Motors recognised by Top Employer for excellent workplace culture

Bentley Motors is pleased to announce it has been recognised as a UK Top Employer...

The Dacia Sandriders wins the Dakar Rally

The Dacia Sandriders has won the 48th Dakar Rally, the toughest test of car and...

New Ford Taurus Arrives in the Middle East

Ford Middle East and North Africa has marked the official arrival of the new Taurus...

CarpodGo T3 Pro (2025) Review: A Smart Wireless Infotainment Upgrade

The 2025 CarpodGo T3 Pro positions itself as a premium, portable infotainment upgrade for drivers...

Ford Mustang Mach-E GT Arrives in the UAE

Lynk & Co has officially launched in the UAE with a bold, large-scale lifestyle brand...

Lynk & Co Launches in the UAE with a Bold Lifestyle-Performance Experience

Lynk & Co has officially launched in the UAE with a bold, large-scale lifestyle brand...

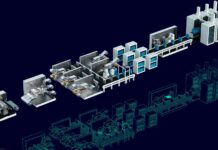

Challenges and Opportunities Ahead for Batteries

By: Puneet Sinha, Senior Director, Battery Industry for Siemens Digital Industries Software

The battery industry is...

Volkswagen Commercial Vehicles saved 100,000 tonnes of CO2….

Volkswagen Commercial Vehicles saved 100,000 tonnes of CO₂ and continues drive towards sustainability at its...

Ford F-150 Lightning is Officially Dead But Will Return as Extended-Range EV

Ford confirmed on Monday the discontinuation of the F-150 Lightning, whose production had been suspended indefinitely...

Lexus LFA Concept, the future of BEV sports cars

Lexus has unveiled...

Skoda Elroq, 100,000 units produced in less than a year

Skoda Elroq has...

Renault 5 E-Tech Electric, new milestone in Douai

The Manufacture Ampere...

KIA EV2, what we know one month after its debut

In January 2026,...

Lancia returns to the world rally championship with Yohan Rossel and Nikolay Gryazin

The appointment with...

Brussels Postpones Announcement on the End of Internal Combustion Engines in 2035

The European Commission delays its crucial decision on the cut-off date for selling internal combustion...

Ford is thinking of a rear-wheel drive electric sedan

Ford's recent product...

Three for one: Sordo, Lappi and Paddon to replace Tänak at Hyundai in 2026

Shortly before the...

Illness at Super Formula debut for Kalle Rovanperä

Uphill straight away...

Alpine, two electric roadsters in the range by 2030

Alpine has announced...