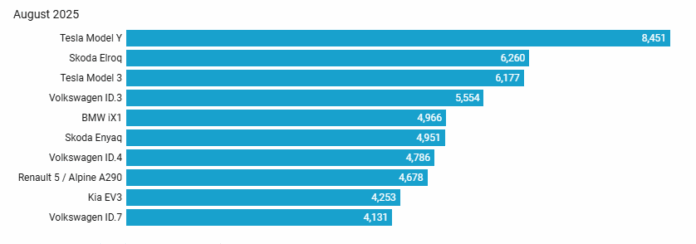

Can Tesla keep its unparalleled lead in Europe’s EV market?

İLGİ ÇEKENLER

Global EV Cables Market Set for Rapid Expansion Through 2030

The global electric vehicle (EV) industry continues to evolve at a remarkable pace, driving strong demand for...

Record Home Sales while the growth in the US new automobile market continues

Record electric vehicle (home) sales, the US, the new car deliveries in the US in...

French new automobile market recorded another improvement in September

Bevs increased French records with the new low level of gasoline. The cordless electric vehicle...

PHEV sales fell to its low level in China

In China, the battery-powered electric vehicle (BEV) sales continued to grow in July, while Plug-in...

An assessment of what expects JLR and its suppliers?

How did Plug-in hybrid (PHEV) sales go in China? Is it too early to celebrate...

Can the Netherlands lead the electric light commercial vehicle revolution?

This year, the Netherlands is leading the recruitment of an electric light commercial vehicle (LCV)....