Tesla is quietly taking the title of Europe’s best-selling battery electric vehicle (BEV) as plug-in hybrid (PHEV) deliveries continue to rise. So, is it too late for local competitors to catch up?

EV Volumes latest data shows that the European PHEV market grew by 53.9% year-on-year in August. This equated to 82,308 new units with the technology hitting the roads.

This was an improvement over July’s result, which was the best volume increase since June 2021. The result showed a double-digit improvement for the sixth consecutive month and underlines the growing appeal of powertrains.

Meanwhile, 158,225 battery electric vehicles (BEVs) were delivered per month. This corresponded to a 24.6% increase in sales, extending the streak of double-digit increases. All-electric model deliveries have seen volume increases every month so far in 2025.

These unwavering performances meant that BEVs saw a greater cumulative improvement than PHEVs between January and July. However, August was a turning point. PHEV volumes increased by 28.3% in the first eight months of the year to 789,268 units. Meanwhile, BEVs achieved a 25.8% increase. However, it maintained larger volume with 1,544,223 deliveries during this period.

Deliveries of electric vehicles (EVs), which combine two powertrains, increased by 33.3% in August to 240,533 units. In the first eight months of the year, 2,333,491 new electric vehicles hit European roads, an increase of 26.7%.

BEVs continued to make up the majority of EV deliveries, but their grip has eased slightly from a year ago. Technology accounted for 65.8% of total EV deliveries in August, down 4.6 points (pp) from August 2024. The smaller decline occurred in cumulative figures, with its share falling from 66.6% to 66.2%.

Tesla expands its leadership

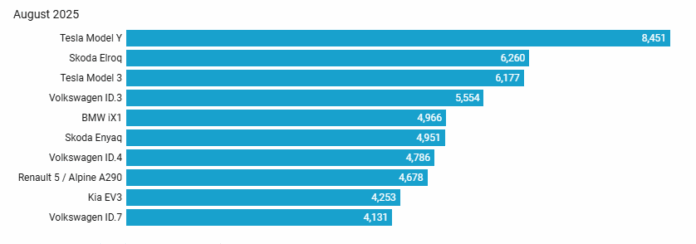

This year has been a bumpy year for Tesla Model Y. Looking at Europe’s BEV bestsellers chart, the crossover has ranked either first or ninth since February.

This can be partly explained by the three-month delivery cycle. The model’s two highest volume months came in March and June. However, at the beginning of the next quarter, BEV fell to the back of the table. It then regained momentum the following month. Model Y continued this trend, topping the table in August after a disappointing July.

The crossover recorded 2,191 sales to take its fifth win of the year, 8,451 units ahead of its closest rival. But it wasn’t all good news for Tesla Model Y. Their volumes were down 37.3% from a year ago. On the other hand, its market share decreased by half compared to August 2024, falling to 5.3%.

Skoda Elroq remains popular

July’s best-selling BEV, Skoda Elroq, came second out of 10ness sales month. A total of 6,260 deliveries of the model translated into a market share of 4%. After breaking into the top 10 for the first time in April, it has only reached the top three places.

Behind it was the Tesla Model 3, which entered the top three for the fourth time in 2025. Its deliveries increased by 9.9% to 6,177 units. Sedans captured 3.9% of BEV volumes, down 0.5 points year-on-year. The US model has also had a bumpy ride in the first eight months of 2025. He only finished in the top 10 four times.

Volkswagen’s (VW) ID.3 ranked fourth with 5,554 units, up 58.8% from August 2024. The hatchback has maintained consistent deliveries throughout 2025, with monthly volumes ranging from 5,399 units to 6,932 units. But their positions are mixed.

BMW’s good form continues

After achieving its best result of the year with fourth place in July, the BMW iX1 continued to prove a popular choice with fifth place in August. The SUV recorded 4,966 sales, up 33% from 12 months ago. The share of the model increased from 2.9% to 3.1%.

In the shadow of its little brother, the Skoda Enyaq finished sixth. With 15 deliveries, it was only 4,951 units behind the BMW iX1. This represented a 20.4% decline year-on-year and was the lowest volume month of 2025 so far. Its share later fell by 1.8 points to 3.1%.

In contrast, deliveries of the seventh-ranked VW ID.4 increased by 18.3%. However, its total volume of 4,786 units was also the crossover’s lowest monthly volume in 2025. Due to increased competition, its market share decreased by 0.2 points to 3%.

Renault 5 and Alpine A290 took the eighth place with a total of 4,678 units. This corresponded to a market share of 3%. Kia EV3 ranked ninth with 4,253 units out of 11. The model accounted for 2.7% of total BEV volumes. It has appeared in every monthly top 10 chart so far this year, except for June.

VW ID.7 received 10the lowest finishing position in the first eight months of 2025. It also recorded the lowest monthly delivery figure of the year with 4,131 units. However, this was still a significant improvement from 12 months earlier, equating to a 46.6% increase in sales. ID.7 accounted for 0.4% of the market, up 2.6 points.

Can Tesla survive?

Following its victory in August, Tesla Model Y extended its lead on the annual list. It looks set to be Europe’s best-selling BEV this year.

The crossover saw 83,194 deliveries in the first eight months of the year. A difference of 32,569 units separates it from its closest rival as it has a market share of 5.4%. It seems unlikely that the Tesla Model Y will be available by the end of the year.

The model’s closest competitors have had difficulty passing the 10,000-unit threshold in any month this year. The only other BEV to achieve this feat is the Tesla Model 3.

It still had 4,568 deliveries in April, the Model Y’s lowest-volume month. If the crossover were to repeat this result by December, its rivals would need a significant increase in volumes to mount a challenge.

VW ID.4 ranked second with 50,625 deliveries and 3.3% market share.

Its sibling ID.3 is only 682 units behind. It moved up one place from July’s cumulative ranking with 49,943 sales. The hatchback and the next four positions accounted for a 3.2% share of BEV volumes at the end of August.

While Skoda Enyaq remained in fourth place with 49,748 units, Renault 5 and Alpine A290 dropped two places to fifth place with 49,554 deliveries combined.

Tesla Model 3 recorded 49,524 deliveries in the first eight months of 2025, rising from seventh place in July. This is a promising move ahead of another quarterly reporting period.

Another groundbreaking BEV was Skoda Elroq. Thanks to another strong month, the SUV moved up one spot, producing 48,678 units. This comes at the expense of the VW ID.7 after a disappointing August. A total of 47,693 deliveries translated into a market share of 3.1%.

The Kia EV3 came in ninth with 44,560 sales, accounting for 2.9% of total BEV volumes. The BMW iX1 closed the top 10 with 42,305 deliveries and a share of 2.7%.

Three in a row for VW

In Europe’s PHEV market, the VW Tiguan has now recorded three consecutive months of victory. This follows its initial rise to the top in June. But August was his most decisive victory.

The SUV’s total of 4,010 units represented a 275.5% year-on-year increase. Its share also increased from 2% to 4.9%.

Tiguan surpassed its closest rival, the Volvo XC60, with 667 deliveries. The second-ranked SUV achieved a 27.7% improvement in volumes with 3,343 units in August. However, as the PHEV market became more crowded, the XC60’s share fell by 0.8 points to 4.1%.

Third place went to BYD Seal U with 3,253 units. PHEV continues to impress after a slow start to deliveries in 2024. It took a 4% market share, with an annual increase of 3.5 points. Ford Kuga finished fourth, repeating its July result. It achieved 3,195 sales, an increase of 11.1% compared to August 2024. However, the model’s market share fell from 5.4% to 3.9%.

MG deliveries increase

In fifth place was MG eHS, repeating its best finish of the year in July. The SUV’s total of 2,943 units represented an 819.7% increase in deliveries. As a result, it captured 3.6% of total volumes, up 3 points from 12 months ago.

BMW X1just 14 units behind the MG eHS in sixth place. It recorded 2,929 deliveries, representing a year-on-year growth of 2.4%. However, its market share decreased by 1.7 points to 3.6%.

The Toyota RAV4 ranked seventh, thanks to 2,811 deliveries in August. This represented an increase of 160.5% compared to a year ago. PHEV accounted for 3.4% of the total, up from 2%.

Eighth place went to the Mercedes-Benz GLC, its lowest finishing position since March. Its deliveries were 2,577 units, down 5% compared to August 2024. Meanwhile, the model’s market share decreased by 2 points to 3.1%.

The BMW X3 entered the first monthly top 10 this year in ninth place. This was thanks to 2,318 sales, a significant improvement of 318.4%. Unsurprisingly, market share increased by 1.8 points to 2.8%.

Hyundai Tucson, which completed the top 10 in August, reached the top for the fourth time in the first eight months of 2025. PHEV recorded 2,176 deliveries, indicating a 68.6% increase in volumes. This translated into a market share of 2.6%, up 0.2 points from 12 months ago.

Interestingly, all these models fall under the C and D Segment SUV category compared to six SUVs in the BEV top 10. However, these models may face restrictions in cities such as Cardiff in the future. According to BBC news, higher parking fees may be applied to vehicles over a certain weight.

Tiguan is a few inches ahead

Europe’s PHEV market continued to be dominated by three SUVs. VW Tiguan, Volvo XC60 and BYD Seal have been in the top three every month since April. A total of 3,251 units reserve the models, which means changes could occur by the end of the year.

VW Tiguan maintained its leadership with 38,962 units and 4.9% market share from January to August. It had a consistent performance, with its worst finish being fourth in March.

Volvo’s XC60 has been even more consistent in second place, failing to finish outside the top three in any month of 2025. After eight months of the year, it sold 36,757 units, accounting for a 4.7% share.

Following both SUVs is the BYD Seal U, even after a slow start to the year. However, it has remained in the top three since March. PHEV recorded 35,711 units between January and August, accounting for 4.5% of total volumes.

Ford is out of touch

Ford Kuga, which was once in search of leadership, now seems out of touch thanks to its average performances in April, May and June. The SUV’s total share of 30,203 units gave it a 3.8% share, placing it in fourth place. Behind it was the BMW X1, which represented 3.4% of the total PHEV figures with 26,863 units.

In sixth place was Toyota C-HR, thanks to 23,580 deliveries and a 3% share. Mercedes-Benz GLC ranked seventh with 21,748 deliveries, accounting for 2.8% of total volumes. Then came MG eHS, just 144 units behind. PHEV delivered 21,604 models to customers in the first eight months of the year, achieving a share of 2.7%.

Automobile Magazine – English