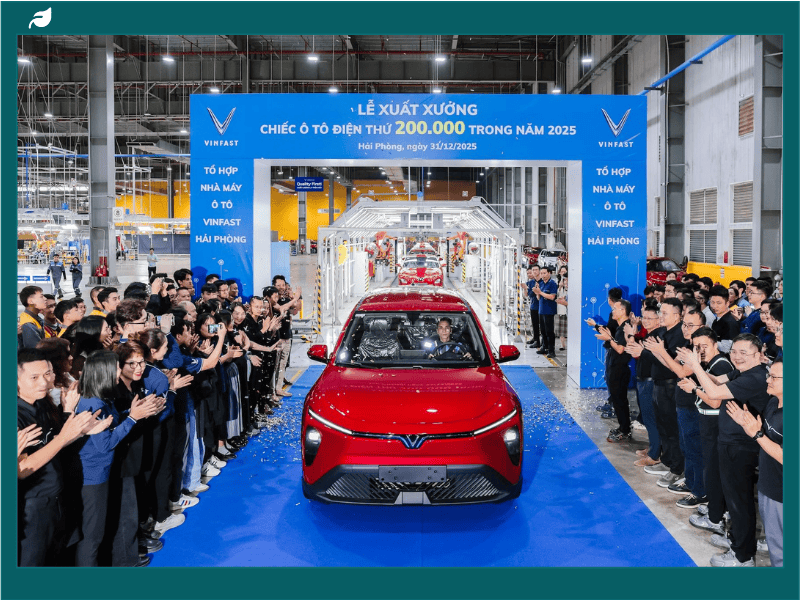

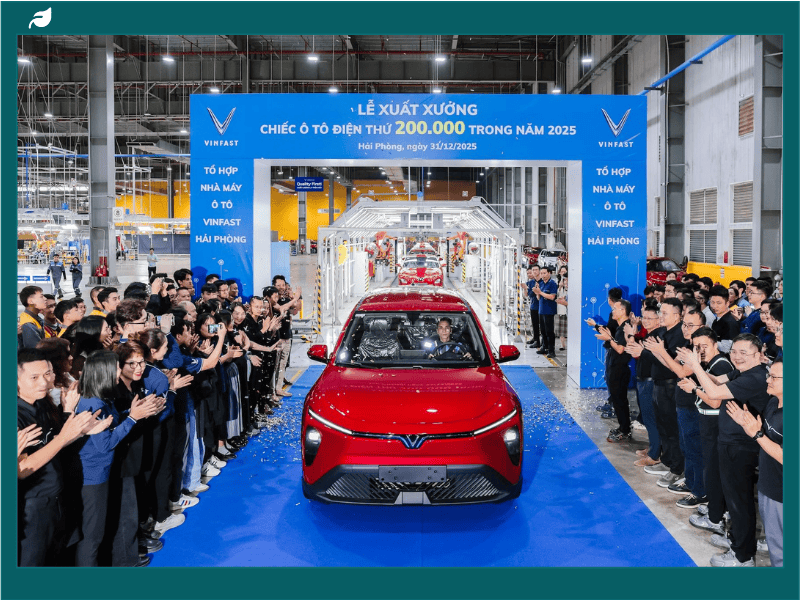

On the final day of 2025, VinFast marked a milestone at its Hai Phong manufacturing complex as the company’s 200,000th vehicle rolled off the production line. The moment capped a year that underscored both VinFast’s rapid expansion and Vietnam’s shifting position in global manufacturing, with electric vehicles increasingly central to that change.

VinFast is Vietnam’s first and only global carmaker, and its performance in 2025 highlighted the scale the company has reached in a relatively short period. The Hai Phong facility operated at full capacity to close the year, reflecting sustained demand and an expanding product footprint at home and abroad.

At the domestic level, VinFast has led Vietnam’s car market for more than a year, outselling established international brands. Its vehicles have become a common feature on Vietnamese roads, used as commuter cars, family vehicles, and for longer-distance travel. Buyers now assess VinFast models against the same benchmarks applied to Japanese, Korean, and European imports, marking a shift in consumer perception in a country long dependent on foreign automotive brands.

Beyond volume, 2025 also saw VinFast move into more specialised manufacturing. During the year, the company introduced the Lac Hong 900 LX, an armored electric vehicle certified to meet the VPAM VR7 ballistic protection standard. This level of protection places VinFast among a small group of manufacturers globally with the technical capacity to produce armored vehicles, and fewer still able to do so on a fully electric platform.

International expansion continued alongside domestic growth. Over the past two years, VinFast has entered markets across North America, Europe, Asia, and the Middle East. In 2025, three new manufacturing plants became operational, including one in Vietnam and two overseas, located in India and Indonesia.

The Indian facility, based in Tamil Nadu, represented a particularly challenging entry point. India’s automotive market is known for intense competition, narrow margins, and limited tolerance for underperforming new entrants. Despite those conditions, VinFast’s electric vehicle lineup gained traction quickly. By December, only months after beginning sales, the company had become India’s fourth largest electric vehicle brand. One Indian outlet described the market entry as having “proved to be a huge success.”

VinFast’s approach to market entry has placed emphasis on ownership experience rather than vehicle sales alone. In regions where electric vehicle adoption is still shaped by practical concerns around servicing, warranties, and reliability, the company has sought to address those issues from the outset.

The Middle East provides a clear example of this strategy in practice. In the region, VinFast positions the VF 8 as a premium midsize electric SUV, supported by a suite of ownership policies designed to reduce buyer hesitation. These include a ten-year or 200,000-kilometre vehicle warranty, a ten-year unlimited-mileage battery warranty, and five years of free servicing. Buyers also have access to mobile service units, 24-hour roadside assistance, and guaranteed parts availability.

Such measures are aimed at building confidence in a market where Vietnam has not traditionally been associated with automotive manufacturing. For many Middle Eastern consumers, the idea of purchasing a Vietnamese-made vehicle represents a departure from long-standing assumptions about where cars are designed and built.

That shift in perception extends beyond individual markets. For decades, Vietnam has been best known internationally as an exporter of agricultural products and light manufactured goods, including rice, footwear, and textiles. VinFast’s growing global presence is contributing to a broader reassessment of the country’s industrial capabilities, particularly in higher-value manufacturing linked to electrification.

Historical parallels are often drawn with South Korea’s automotive rise, where early skepticism in Western markets eventually gave way to widespread acceptance. Vietnam’s trajectory is unfolding under different conditions, shaped by the global transition toward electric mobility and fewer fixed ideas about which countries dominate the automotive sector.

As electrification reshapes supply chains and lowers some of the traditional barriers to entry, manufacturers from newer industrial economies are finding opportunities to compete on more equal footing. VinFast’s progress across multiple regions in 2025 illustrates how those dynamics are playing out in practice.

With production milestones reached, new plants operational, and a growing presence from Southeast Asia to the Middle East, VinFast’s 2025 performance stands as a marker of Vietnam’s changing role in global industry. Electric vehicles have been central to that story, both as a product category and as a symbol of how manufacturing hierarchies are being redefined.