JOHANNESBURG, 2026 – The South African car market is evolving faster than ever, and the latest demand data from Cars.co.za makes that crystal clear. Examining leads submitted on vehicles less than five years old and under 200,000 km during 2025 reveals a market that balances tradition with rapid change, where old favourites struggle to maintain their foothold, and affordable alternatives—particularly Chinese brands—are gaining significant traction.

Toyota and Suzuki Lead, German Luxury Brands Slip

At the brand level, stability remains near the top. Toyota continues to dominate, increasing its lead share from 20.0% in 2024 to 22.4% in 2025, while Suzuki climbs from 8.6% to 10.5%. Volkswagen remains the second-most sought-after brand, though its lead share dips to 15.3%, signaling a subtle shift in buyer priorities.

Traditional German luxury brands—BMW, Mercedes-Benz, and Audi—have all slipped, both in ranking and lead share, suggesting that South African buyers are prioritising affordability and practicality over premium cachet. Meanwhile, Korean and Japanese brands such as Kia, Isuzu, and Chery have made small but notable gains, with Omoda’s impressive leap from 27th to 20th highlighting the growing appeal of newer, value-focused brands.

Among the new entrants, MG has claimed 38th place, while BYD follows closely at 40th. Jetour steals the spotlight as the year’s biggest climber, jumping from 44th to 22nd—a remarkable achievement in a market dominated by established players.

The Rise of Affordable Chinese Brands

The data underscores a clear trend: Chinese brands are no longer niche players. Haval, Chery, Omoda, GWM, and Jetour are climbing the charts, buoyed by competitive pricing, improved quality, and expanding local recognition. This surge reflects a broader global trend, where new-market entrants leverage affordability and practicality to chip away at legacy brands’ dominance.

Model-Level Insights: Pick-Ups and Practicality Reign

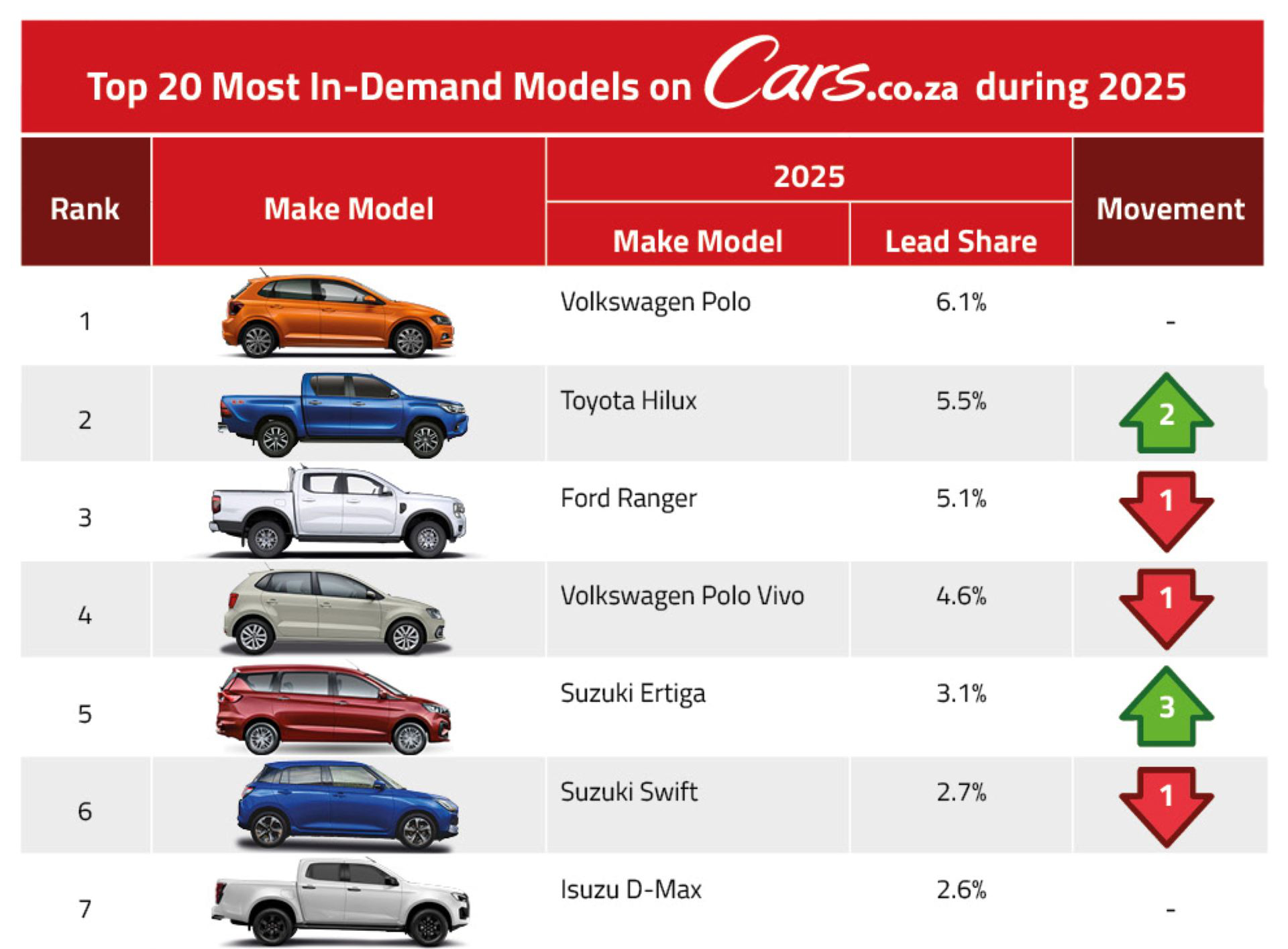

Turning to specific models, the Volkswagen Polo remains South Africa’s most in-demand vehicle, though its lead share has slightly declined. The Toyota Hilux, however, has reclaimed its position as the country’s most desirable bakkie, reflecting the enduring popularity of pick-ups in South Africa’s unique automotive landscape.

The biggest mover within the Top 10 is the Suzuki Ertiga, rising from 8th to 5th. Its Toyota counterpart, the Rumion, also posted a remarkable 13-position jump, indicating strong consumer interest in practical multi-purpose vehicles. Combined, the Ertiga and Rumion match the lead share of the Ford Ranger, highlighting a subtle but significant shift in buyer preferences toward affordable, spacious family vehicles.

Chinese models also made major gains. The Haval Jolion rose eight positions to 13th, while the Chery Tiggo 4 Pro climbed eight slots to 20th. The standout performer is the Chery Tiggo 8 Pro, up 33 places, followed by the Omoda C5 (+28) and Chery Tiggo 7 Pro (+25). Other notable climbers include the Toyota Land Cruiser Prado (+24), Land Cruiser 79 (+19), and GWM P-Series (+16), underscoring the enduring appeal of utility vehicles.

Models in Decline: The Toll of Discontinuation and Changing Tastes

Declines tell an equally compelling story. Vehicles once popular but now discontinued, such as the Ford Figo (-39), Renault Clio (-35), and Nissan Almera (-29), have seen steep drops. Among still-available models, Mazda2 (-21), Renault Duster (-17), and Mercedes-Benz A-Class (-17) recorded the largest declines, reflecting a shift away from certain small cars and premium offerings in favour of versatile, affordable, or family-oriented alternatives.

Looking Ahead: An Evolving Market

The 2025 Cars.co.za data paints a market in flux, balancing long-standing favourites with rising stars. Pick-ups, multi-purpose vehicles, and affordable Chinese models are reshaping the landscape, while German luxury brands and discontinued models lose ground. For buyers, the message is clear: practicality, value, and versatility increasingly drive demand, and manufacturers will need to adapt or risk slipping down the charts in a market that rewards agility as much as legacy.

South Africa’s automotive story in 2025 is one of transformation, where tradition meets disruption, and the race is as much about clever positioning as it is about horsepower.